Timing the Market

Are you looking to buy, but wanting to make sure that you time it right to take advantage of the market? You aren’t alone! I get these types of questions all the time:

I want to buy soon, but want to make sure that the market conditions are right! How do I know when that will be?

I want to wait for rates to drop a little bit more before I put in any offers.

Weren’t rates below 3% not that long ago? How much longer until rates get that low again?

Interest rates can fluctuate a lot from year to year and it is VERY hard to predict exactly what it will do more than even 3 months from now with 100% certainty. (Frankly, it can even be hard to predict day-to-day. It’s a lot like the stock market in this way.)

It’s critical to understand the interplay between low interest rates and higher demand, which has a very direct impact on increasing purchase prices and therefore not only the mortgage payment, but also the home insurance costs (more expensive home = more expensive insurance), and property taxes. Lower interest rates = more competition, harder to get offers accepted, higher purchase prices.

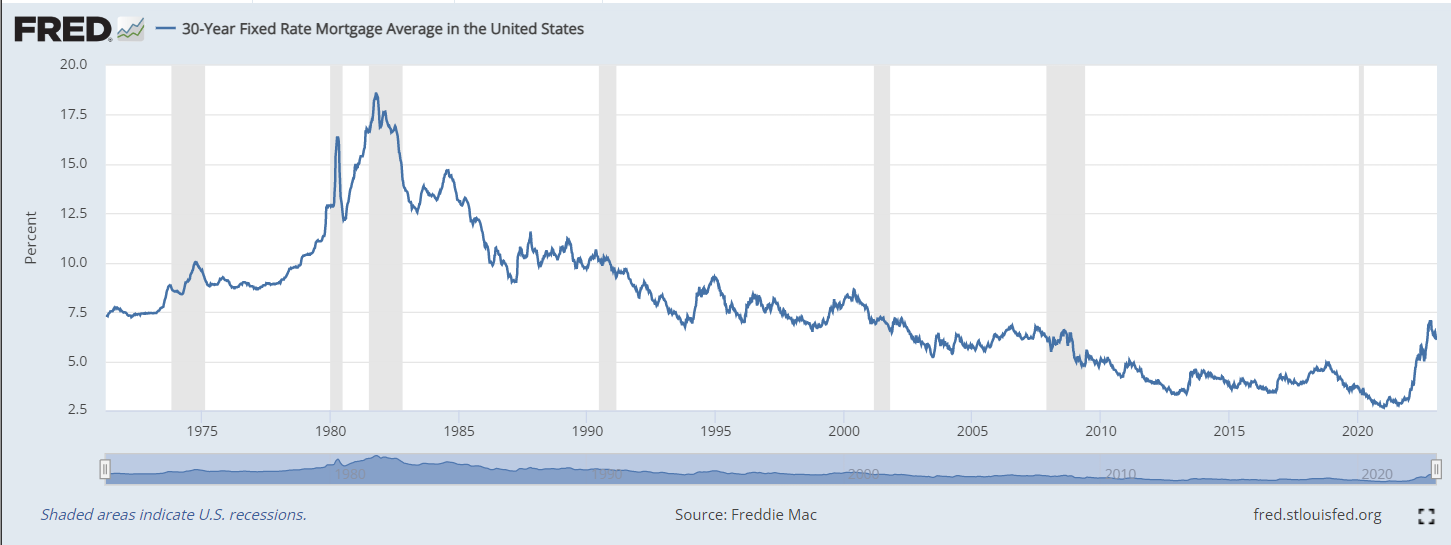

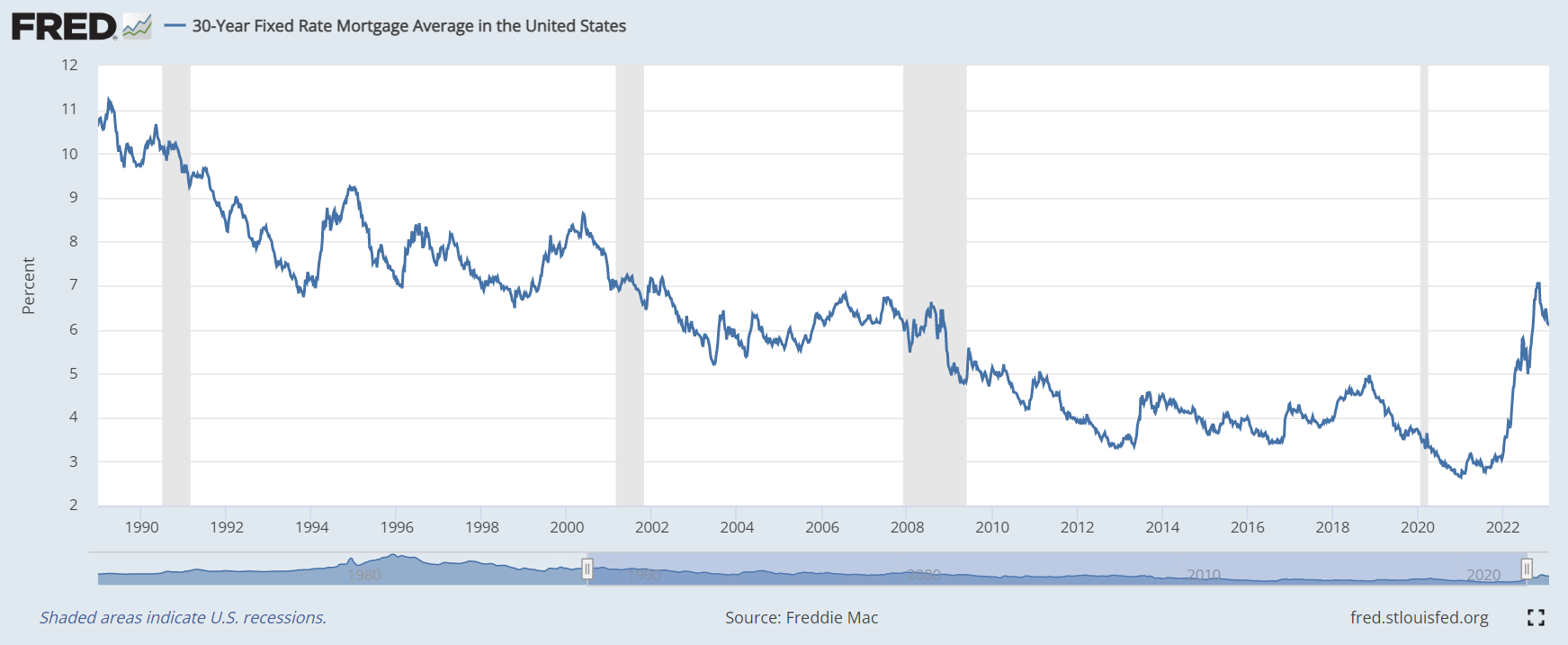

I also want to mention some historical context that the 30-year mortgage interest rate never went below 5% until AFTER the Great Recession of 2008. It went as low as it did because the Government/Fed wanted to stimulate housing demand as there was way too much supply (too many homes were built in the 2000s; now we don’t have enough!). The too-low interest rates for too long is what led us to the housing frenzy in the last years and also has been a big part of why inflation got as bad as it did. The Government/Fed knows this and I highly doubt they will be stimulating the mortgage market in the same way anytime in the next decade unless we have a really bad recession. Even then, I am not sure why they would want to overstimulate the housing sector again specifically with demand in that way. Personally, I believe it would be helpful for the government to stimulate the supply-side more so than demand side (interest rates and down payment programs) to reduce housing prices overall (increase in supply = reduction in price). New home construction has gotten way out of hand in terms of costs.

Here is the data on the 30-year rate over time:

All years available (1971 – today)

1990 – today

Source: https://fred.stlouisfed.org/series/MORTGAGE30US

I personally believe it’s important to look at broader financial considerations for yourselves than the interest rate specifically.

We also can say more about home appreciation with better certainty, as this is more based on population dynamics, construction permits, and is much more stable than interest rates. Home prices in Madison, WI, for example, are likely to go up ~2-5% per year (depending on the exact neighborhood you want) over the next few years.

Finally, I’d be remiss if I didn’t mention that refinancing does allow you to capture a lower interest rate if indeed rates lower. You can always buy at one rate and then refinance to a lower rate even 6 months after your purchase, depending on the cost-benefit analysis of where you are at. As a practical example, a refi does cost ~5k in fees, though these can be completely rolled into a mortgage (and I recommend doing this when analyzing the cost-benefit of whether to refi). If a refi would save you 200/month, that’s a 25-month break-even just looking at the costs alone (5000/200).

If you want to get in touch to discuss your options, reach out today! Call or text: 608-575-1226, or use our Contact Us page.